Evans Realty was established in 1985 and servicing the Treasure Valley for the past 39 years.

Why You Shouldn’t Fear Today’s Foreclosure Headlines

If you’ve seen recent headlines about foreclosures surging in the housing market, you’re certainly not alone. There’s no doubt, the stories in the media can be pretty confusing right now. They may even make you think twice about buying a home for fear that prices could crash. The reality is, the data shows a foreclosure crisis is not where the market is headed, and understanding what that really means is mission critical if you want to know the truth about what’s happening today. Here’s a deeper look.

According to the Year-End 2022 U.S. Foreclosure Market Report from ATTOM, foreclosure filings are up 115% from 2021, but down 34% from 2019. As media headlines grab onto this 115% increase, it’s more important than ever to put that percentage into context.

While the number of foreclosure filings did more than double last year, we need to remember why that happened and how it compares to more normal, pre-pandemic years in the market. Thanks to the forbearance program and other relief options for homeowners, foreclosure filings were down to record-low levels in 2020 and 2021, so any increase last year is — no surprise — a jump up. Rick Sharga, Executive VP of Market Intelligence at ATTOM, notes:

“Eighteen months after the end of the government’s foreclosure moratorium, and with less than five percent of the 8.4 million borrowers who entered the CARES Act forbearance program remaining, foreclosure activity remains significantly lower than it was prior to the COVID-19 pandemic. It seems clear that government and mortgage industry efforts during the pandemic, coupled with a strong economy, have helped prevent millions of unnecessary foreclosures.”

Clearly, these options meant millions of homeowners could stay in their homes, allowing them to get back on their feet during a very challenging period. With home values rising at the same time, many homeowners who may have found themselves facing foreclosure under other circumstances were able to leverage their equity and sell their houses rather than face foreclosure, and that trend continues today.

And remember, as the graph below shows, foreclosures today are far below the record-high 2.9 million that were reported in 2010 when the housing market crashed.

So, while foreclosures are rising, keeping perspective in mind is key. As Bill McBride, Founder and Author of Calculated Risk, noted just last week:

“The bottom line is there will be an increase in foreclosures over the next year (from record low levels), but there will not be a huge wave of distressed sales as happened following the housing bubble. The distressed sales during the housing bust led to cascading price declines, and that will not happen this time.”

Bottom Line

Right now, putting the data into context is more important than ever. While the housing market is experiencing an expected rise in foreclosures, it’s nowhere near the crisis levels seen when the housing bubble burst, and that won’t lead to a crash in home prices.

The 3 Factors That Affect Home Affordability

If you’ve been following the housing market over the last couple of years, you’ve likely heard about growing affordability challenges. But according to experts, the key factors that determine housing affordability are projected to improve this year. Selma Hepp, Executive, Deputy Chief Economist at CoreLogic, shares:

“. . . with slowly improving affordability and a more optimistic economic outlook than previously believed, the housing market could show resilience in 2023.”

The three measures used to establish home affordability are home prices, mortgage rates, and wages. Here’s a closer look at each one.

1. Mortgage Rates

Mortgage rates shot up to over 7% last year, causing many buyers to put their plans on hold. But things are looking different today as rates are starting to come down. George Ratiu, Senior Economist at realtor.com, explains:

“Let’s celebrate some good news. . . . mortgage rates are down. With inflation showing a tangible slowdown, I do expect mortgage rates to follow suit in the months ahead.”

Even a small change in rates can impact your purchasing power. Nadia Evangelou, Director of Forecasting for the National Association of Realtors (NAR), gives this context:

“With a 6% rate instead of 7%, buyers pay about $2,700 less every year on their mortgage. As a result, owning a home becomes affordable to about 1.4 million more renters and 4.3 million more homeowners.”

If 7% rates paused your homebuying plans last year, this could be the opportunity you need to get back in the game. Be sure to work with a team of experts who know the latest on mortgage rates and can give you the best advice for the current market.

2. Home Prices

The second factor at play is home prices. Home prices have made headlines over the past few years because they skyrocketed during the pandemic. When discussing home prices in 2023, Lawrence Yun, Chief Economist at NAR, says:

“After a big boom over the past two years, there will essentially be no change nationally . . . Half of the country may experience small price gains, while the other half may see slight price declines.”

So, while prices will likely be flat this year in some markets, others could see small gains or slight declines. It all depends on your local area. For insight into what’s happening in your market and how prices are impacting affordability, reach out to a trusted real estate professional.

3. Wages

The final component in the affordability equation is wages. The graph below uses data from the Bureau of Labor Statistics (BLS) to show how wages have increased over time:

When you think about affordability, remember the full picture includes more than just mortgage rates and prices. Wages need to be factored in as well. Because wages have been rising, many buyers have renewed opportunity in the market.

While affordability hurdles are not completely going away this year, based on current trends and projections, 2023 should bring some sense of relief to homebuyers who have faced growing challenges. As Mike Fratantoni, Chief Economist at the Mortgage Bankers Association (MBA), says:

“Rates are expected to move lower for the year, and home price growth is expected to cool, both of which will help affordability challenges.”

Bottom Line

If you have questions, let’s connect. You’ll also want to make sure you have a trusted lender so you can explore your financing options. You may be closer to owning a home than you think.

Want To Sell Your House? Price It Right.

Last year, the housing market slowed down in response to higher mortgage rates, and that had an impact on home prices. If you’re thinking of selling your house soon, that means you’ll want to adjust your expectations accordingly. As realtor.com explains:

“. . . some of the more prominent pandemic trends have changed, so sellers might wish to adjust accordingly to get the best deal possible.”

In a more moderate market, how you price your house will make a big difference to not only your bottom line, but to how quickly your house could sell. And the reality is, homes priced right are still selling in today’s market.

Why Pricing Your House Appropriately Matters

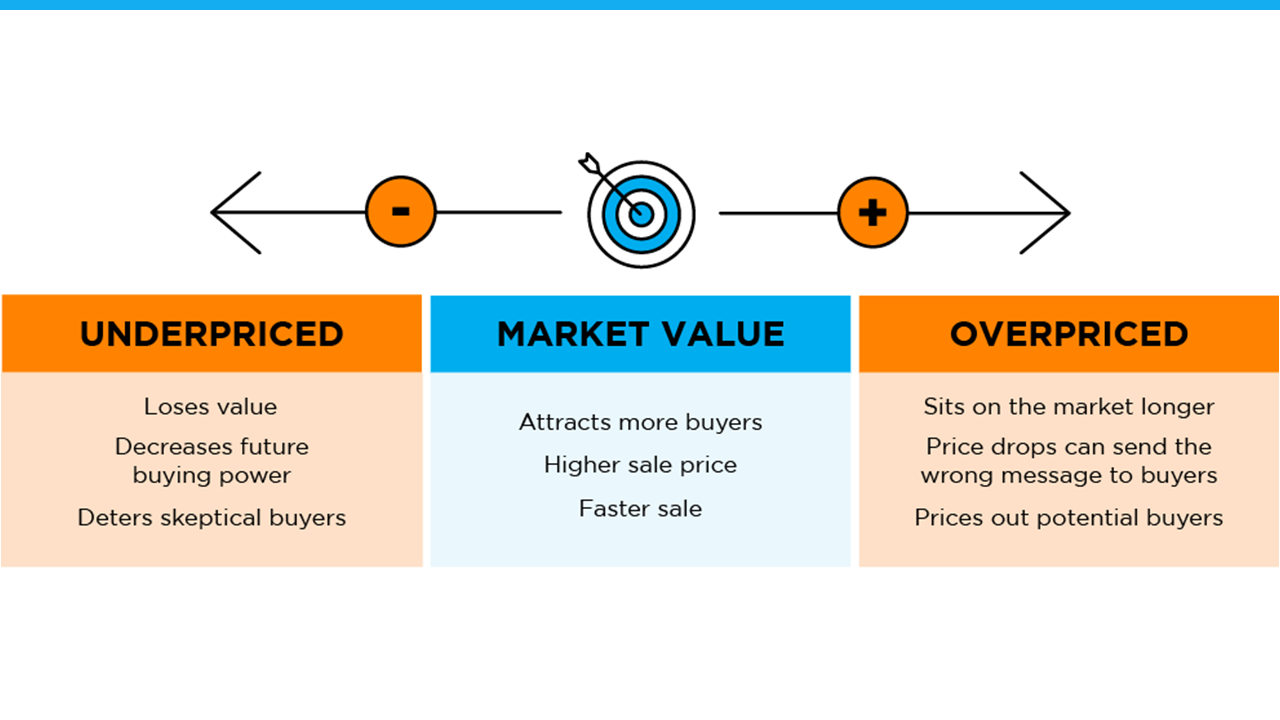

Especially today, your asking price sends a message to potential buyers.

If it’s priced too low, you may leave money on the table or discourage buyers who may see a lower-than-expected price tag and wonder if that means something is wrong with the home.

If it’s priced too high, you run the risk of deterring buyers. When that happens, you may have to lower the price to try to reignite interest in your house when it sits on the market for a while. But be aware that a price drop can be seen as a red flag by some buyers who will wonder what that means about the home.

To avoid either headache, price it right from the start. A real estate professional knows how to determine that ideal asking price. They balance the value of homes in your neighborhood, current market trends, buyer demand, the condition of your house, and more to find the right price. This helps lead to stronger offers and a greater likelihood your house will sell quickly.

The visual below helps summarize the impact your asking price can have:

Bottom Line

Homes that are priced at current market value are still selling. To make sure you price your house appropriately, maximize your sales potential, and minimize your hassle, let’s connect.

What’s Really Happening with Home Prices? [INFOGRAPHIC]

Some Highlights

- If you’re thinking about selling your house, recent headlines about home prices falling month-over-month may have you second guessing your decision—but perspective matters.

- While home prices are down slightly month-over-month in some markets, home values are still up almost 10% nationally on a year-over-year basis. A nearly 10% gain is still dramatic compared to the more normal level of appreciation, which is 3-4%.

- Let’s connect to find out how much equity you have in your current home and how you can use it to fuel your next purchase.

Pre-Approval in 2023: What You Need To Know

One of the first steps in your homebuying journey is getting pre-approved. To understand why it’s such an important step, you need to understand what pre-approval is and what it does for you. Business Insider explains:

“In a preapproval [sic], the lender tells you which types of loans you may be eligible to take out, how much you may be approved to borrow, and what your rate could be.”

Basically, pre-approval gives you critical information about the homebuying process that’ll help you understand your options and what you may be able to borrow.

How does it work? As part of the pre-approval process, a lender will look at your finances to determine what they’d be willing to loan you. From there, your lender will give you a pre-approval letter to help you understand how much money you can borrow. That can make it easier when you set out to search for homes because you’ll know your overall numbers. And with higher mortgage rates impacting affordability for many buyers today, a solid understanding of your numbers is even more important.

Pre-Approval Helps Show You’re a Serious Buyer

Another added benefit is pre-approval can help a seller feel more confident in your offer because it shows you’re serious about buying their house. A recent article from Forbes notes:

“From the seller’s perspective, a preapproval [sic] letter from a reputable local lender often can make the difference between accepting and rejecting an offer.”

This goes to show, even though you may not face the intense bidding wars you saw if you tried to buy during the pandemic, pre-approval is still an important part of making a strong offer. In fact, Christy Bieber, Personal Finance Writer at The Motley Fool explains it may be the most important part of making an offer:

“Pre-approval maximizes the chances you’ll be able to actually close the deal – and sellers want to see that.

The fact that a pre-approval gives you a better chance of getting your offer accepted is undoubtedly the most important reason to complete this step . . .”

Bottom Line

Getting pre-approved is an important first step towards buying a home. It lets you know what you can borrow and shows sellers you’re serious about purchasing their home. Connect with a local real estate professional and a trusted lender so you have the tools you need to purchase a home in today’s market.

![What’s Really Happening with Home Prices? [INFOGRAPHIC] | Simplifying The Market](https://files.simplifyingthemarket.com/wp-content/uploads/2023/01/19133822/Whats-Really-Happening-With-Home-Prices-MEM.png)