Evans Realty was established in 1985 and servicing the Treasure Valley for the past 39 years.

Life-Changing Events That Move the Housing Market

November 13, 2023

Life is a journey filled with unexpected twists and turns, like the excitement of welcoming a new addition, retiring and starting a new adventure, or the bittersweet feeling of an empty nest. If something like this is changing in your own life, you may be considering buying or selling a house. That’s because through all these life-altering events, there is one common thread—the need to move.

Reasons People Still Need To Move Today

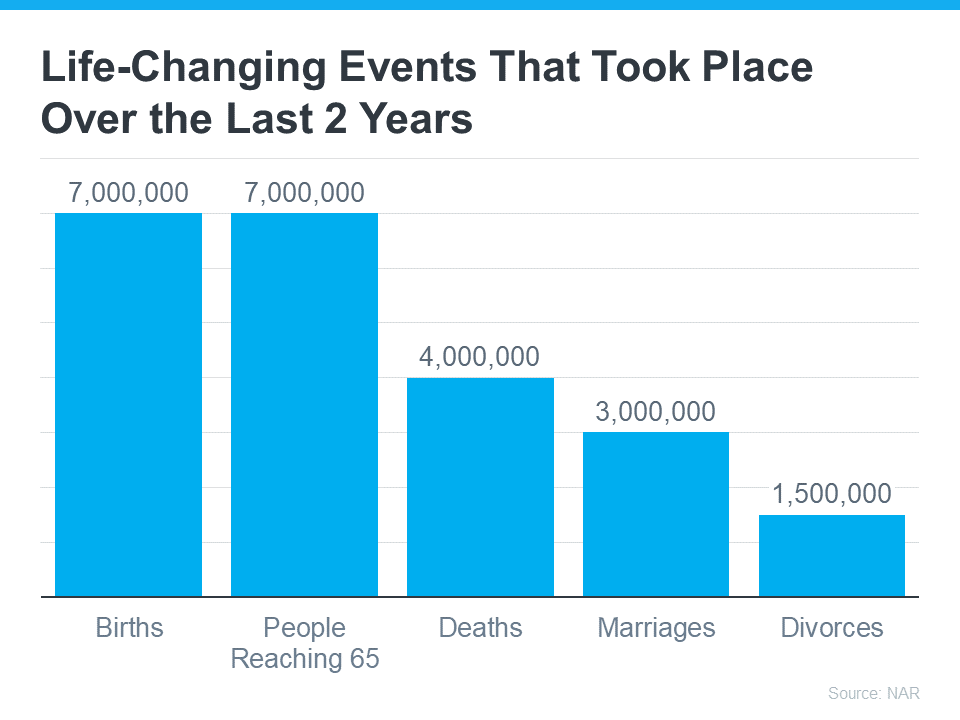

According to the National Association of Realtors (NAR) there have been a lot of this type of milestone or life change over the last two years (see graph below):

And, these big life changes are going to continue to impact people moving forward, even with the current affordability challenges brought on by higher mortgage rates and rising home prices.

As Claire Trapasso, Executive News Editor at Realtor.com, says:

"Because high mortgage rates, elevated home prices, and stubbornly low inventory make today's housing market particularly challenging, many of today's buyers are motivated by life changes, such as growing families, supporting elderly parents or grown children, or accommodating professional needs. . .”

Lean On a Real Estate Professional for Help

Whether you're beginning your search for a home or preparing to sell your current house, you don't have to go it alone. With their expertise, a real estate agent is an invaluable partner who can help you smoothly transition through these big moments in your life. Here are just a few examples.

When Buying a Home

If you’re welcoming a new addition and want more space, the need for a new home may be a top priority. While higher home prices and mortgage rates are creating challenges for buyers, you may have to find a way to meet your changing needs, even with today’s mortgage rates.

A skilled real estate agent can help. Their expertise and knowledge of the local housing market can save you a considerable amount of time and stress. An agent will take the time to understand your specific needs, budget, and preferences, allowing them to narrow down your search and present you with suitable options.

When Selling a House

If you’re retiring or going through a separation or divorce, your main focus may be to make the most out of your investment when selling your house, so you can find one that works better for you moving forward.

This is another place where a real estate agent's expertise truly shines. They can accurately assess your home's market value, suggest improvements to enhance its appeal, and craft a strategic marketing plan. Their negotiation skills are a big asset when it comes to making sure you get a fair price for your house, allowing you to move on to the next chapter of your life with confidence and peace of mind.

No matter your situation, lean on a trusted professional for help as you buy or sell a home.

Bottom Line

If recent life-changing events have you wanting or needing to move, let’s connect.

The information contained, and the opinions expressed, in this article are not intended to be construed as investment advice. Keeping Current Matters, Inc. does not guarantee or warrant the accuracy or completeness of the information or opinions contained herein. Nothing herein should be construed as investment advice. You should always conduct your own research and due diligence and obtain professional advice before making any investment decision. Keeping Current Matters, Inc. will not be liable for any loss or damage caused by your reliance on the information or opinions contained herein.

Thinking About Using Your 401(k) To Buy a Home?

November 8, 2023

Are you dreaming of buying your own home and wondering about how you’ll save for a down payment? You're not alone. Some people think about tapping into their 401(k) savings to make it happen. But before you decide to dip into your retirement to buy a home, be sure to consider all possible alternatives and talk with a financial expert. Here’s why.

The Numbers May Make It Tempting

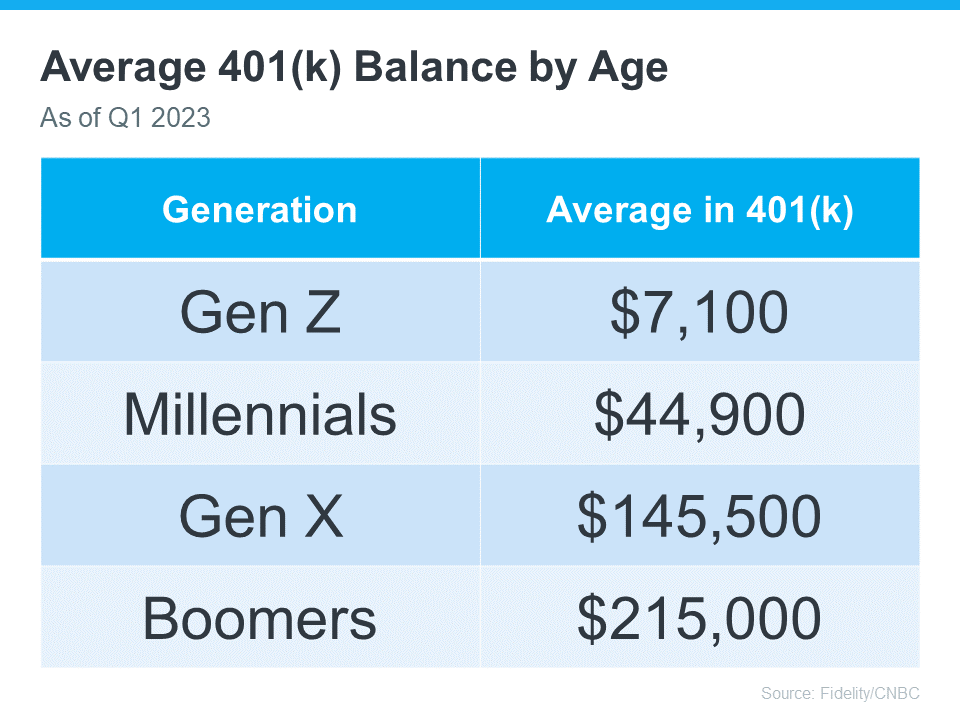

The data shows many Americans have saved a considerable amount for retirement (see chart below):

It can be really tempting when you have a lot of money saved up in your 401(k) and you see your dream home on the horizon. But remember, dipping into your retirement savings for a home could cost you a penalty and affect your finances later on. That's why it's important to explore all your options when it comes to saving for a down payment and buying a home. As Experian says:

“It’s possible to use funds from your 401(k) to buy a house, but whether you should depends on several factors, including taxes and penalties, how much you’ve already saved and your unique financial circumstances.”

Alternative Ways To Buy a Home

Using your 401(k) is one way to finance a home, but it's not the only option. Before you decide, consider a couple of other methods, courtesy of Experian:

- FHA Loan: FHA loans allow qualified buyers to put down as little as 3.5% of the home's price, depending on their credit scores.

- Down Payment Assistance Programs: There are many national and local programs that can help first-time and repeat homebuyers come up with the necessary down payment.

Above All Else, Have a Plan

No matter what route you take to purchase a home, be sure to talk with a financial expert before you do anything. Working with a team of experts to develop a concrete plan prior to starting your journey to homeownership is the key to success. Kelly Palmer, Founder of The Wealthy Parent, says:

“I have seen parents pausing contributions to their retirement plans in favor of affording a larger home often with the hope they can refinance in the future… As long as there is a tangible plan in place to get back to saving for their retirement goals, I encourage families to consider all their options.”

Bottom Line

If you’re still thinking about using your 401(k)-retirement savings for a home down payment, consider all your options and work with a financial professional before you make any decisions.

The information contained, and the opinions expressed, in this article are not intended to be construed as investment advice. Keeping Current Matters, Inc. does not guarantee or warrant the accuracy or completeness of the information or opinions contained herein. Nothing herein should be construed as investment advice. You should always conduct your own research and due diligence and obtain professional advice before making any investment decision. Keeping Current Matters, Inc. will not be liable for any loss or damage caused by your reliance on the information or opinions contained herein.

Homeowner Net Worth Has Skyrocketed

November 7, 2023

If you’re weighing your options to decide whether it makes more sense to rent or buy a home today, here’s one key data point that could help you feel more confident in making your decision. Every three years, the Federal Reserve Board releases the Survey of Consumer Finances (SCF). That report covers the difference in net worth for both homeowners and renters. Spoiler alert: the gap between the two is significant.

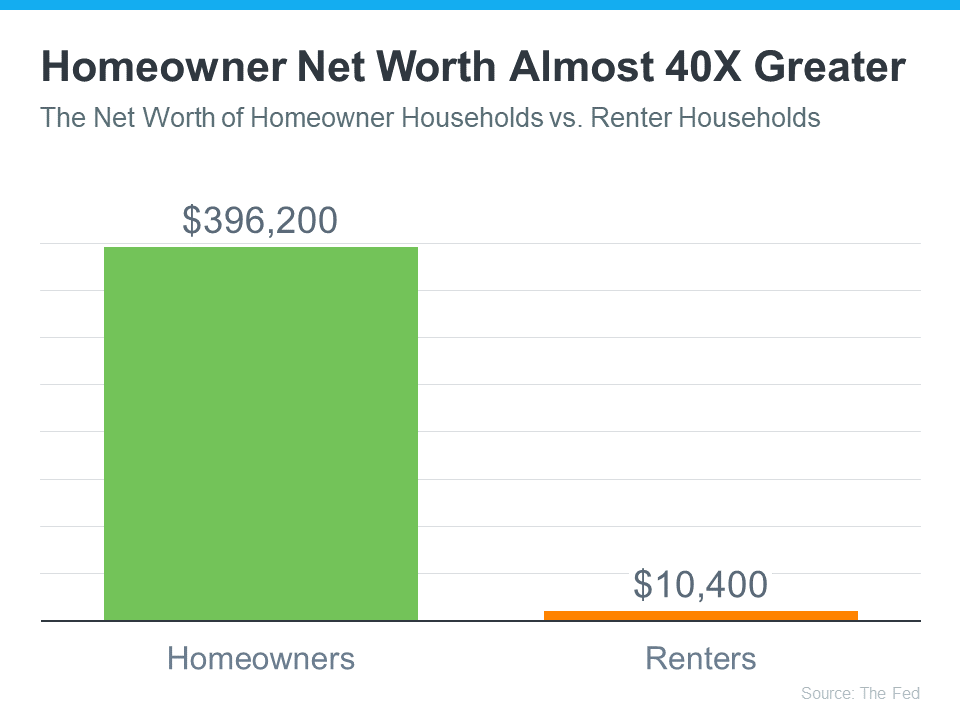

The average homeowner’s net worth is almost 40X greater than a renter’s. And here’s the data to prove it (see graph below):

The Big Reason Homeowner Net Worth Is So High

In the previous version of that report, the net worth of the average homeowner was roughly $255,000 and that of the average renter was $6,300. But in the release that just came out this year, the gap widened as homeowner net worth climbed dramatically. As the Survey of Consumer Finances (SCF) report says:

“. . . the 2019-2022 growth in median net worth was the largest three-year increase over the history of the modern SCF, more than double the next-largest one on record.”

One of the biggest reasons homeowner net worth skyrocketed is home equity.

Over the last few years, known as the ‘unicorn’ years for housing, home prices went through the roof. That’s because there weren’t enough homes for sale, and there was a big influx of buyers rushing to buy them and take advantage of the then record-low mortgage rates. That imbalance of supply and demand pushed prices higher and higher. As a result, most homeowners who had a home during that time saw their equity grow a lot.

If you’re still in the middle of making your decision on whether to rent or buy, you may wonder if you missed the boat on the big net worth boost. But here’s what you need to realize. As a recent article in The Ascent explains:

“Whether your net worth increased in recent years or not, there are steps you can take to boost that number in the coming years. . . buying a home can be a great way to grow your net worth, since home values have a tendency to rise over time.”

Historically, home prices climb over time. Even now that mortgage rates are closer to 7-8%, prices are still rising in many areas of the country because supply is still low compared to demand. That’s why expert forecasts for the next few years call for ongoing appreciation – just at a pace that’s more typical for the housing market.

While it likely won’t be the record ramp-up that happened over the last few years, people who buy now should continue to grow equity in the years ahead. That means, if you’re ready and able to buy a home today, you’ll be making an investment that’ll help build your net worth in the long run.

As Jessica Lautz, Deputy Chief Economist at the National Association of Realtors (NAR), says:

“. . . when deciding to rent vs buy, one must calculate the total cost of homeownership (maintenance, utilities, commuting, etc.) and the total financial benefit. Based on new Fed data . . . the median net worth of homeowners was $396,200 vs renters at $10,400. There is no question about the wealth gains that homeownership provides.”

Bottom Line

If you’re on the fence about whether to rent or buy a home, remember that homeownership can give your net worth a big boost over time. If you want to learn more about this or the many other benefits of owning a home, let’s connect.

The information contained, and the opinions expressed, in this article are not intended to be construed as investment advice. Keeping Current Matters, Inc. does not guarantee or warrant the accuracy or completeness of the information or opinions contained herein. Nothing herein should be construed as investment advice. You should always conduct your own research and due diligence and obtain professional advice before making any investment decision. Keeping Current Matters, Inc. will not be liable for any loss or damage caused by your reliance on the information or opinions contained herein.

The Benefits of Buying a Multi-Generational Home [INFOGRAPHIC]

November 3, 2023

Some Highlights

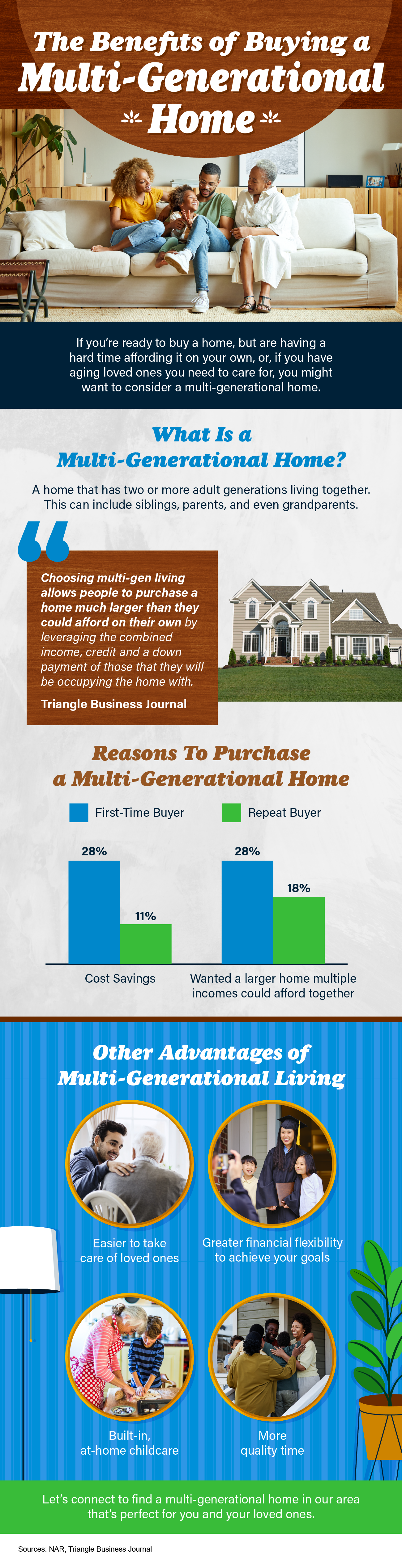

- If you’re ready to buy a home but are having a hard time affording it on your own, or, if you have aging loved ones you need to care for, you might want to consider a multi-generational home.

- Living with siblings, parents, and even grandparents can help you save money, give or receive childcare, and spend quality time together.

- Let’s connect to find a home in our area that’s perfect for you and your loved one’s needs.

The information contained, and the opinions expressed, in this article are not intended to be construed as investment advice. Keeping Current Matters, Inc. does not guarantee or warrant the accuracy or completeness of the information or opinions contained herein. Nothing herein should be construed as investment advice. You should always conduct your own research and due diligence and obtain professional advice before making any investment decision. Keeping Current Matters, Inc. will not be liable for any loss or damage caused by your reliance on the information or opinions contained herein.

Don’t Believe Everything You Read About Home Prices

According to the latest data from Fannie Mae, 23% of Americans still think home prices will go down over the next twelve months. But why do roughly 1 in 4 people feel that way?

It has a lot to do with all the negative talk about home prices over the past year. Since late 2022, the media has created a lot of fear about a price crash and those concerns are still lingering. You may be hearing people in your own life saying they’re worried about home prices or see on social media that some influencers are saying prices are going to come tumbling down.

If you’re someone who still thinks prices are going to fall, ask yourself this: Which is a more reliable place to get your information – clickbait headlines and social media or a trusted expert on the housing market?

The answer is simple. Listen to the professionals who specialize in residential real estate.

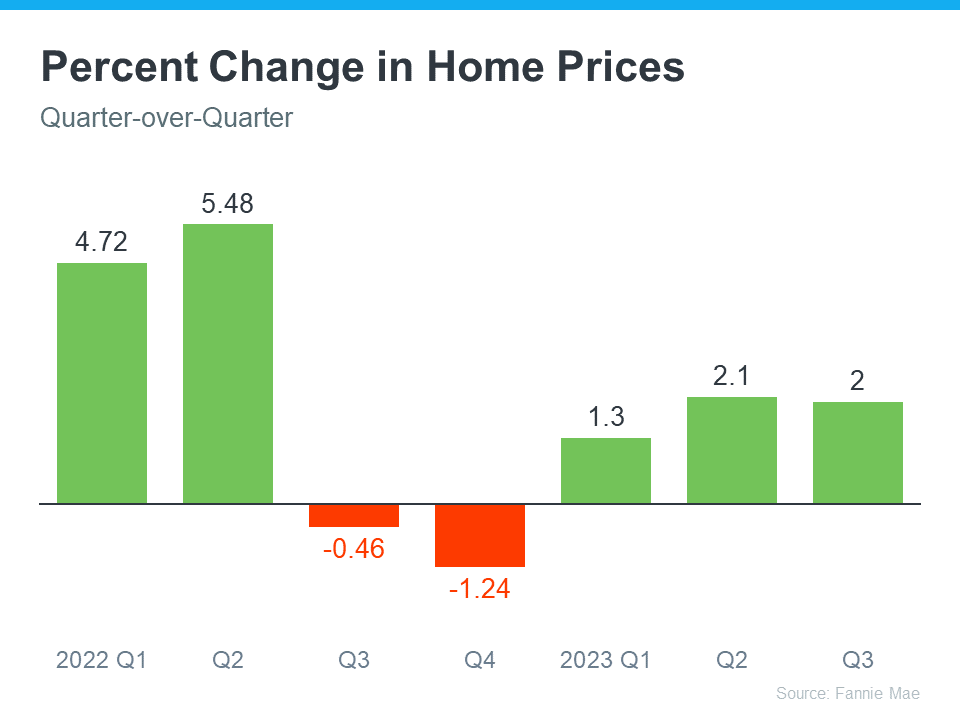

Here’s the latest data you can actually trust. Housing market experts acknowledge that nationally, prices did dip down slightly late last year, but that was short-lived. Data shows prices have already rebounded this year after that slight decline in 2022 (see graph below):

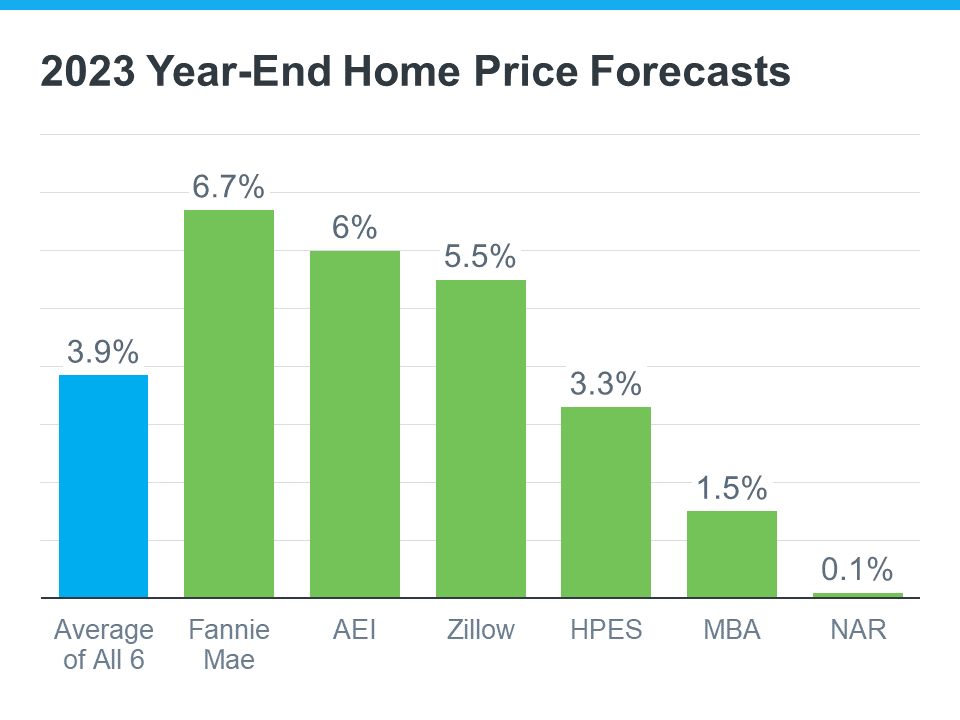

But it’s not just Fannie Mae that’s reporting this bounce back. Experts from across the industry are showing it in their data too. And that’s why so many forecasts now project home prices will net positive this year – not negative. The graph below helps prove this point with the latest forecasts from each organization:

What’s worth noting is that, just a few short weeks ago, the Fannie Mae forecast was for 3.9% appreciation in 2023. In the forecast that just came out, that projection was updated from 3.9% to 6.7% for the year. This increase goes to show just how confident experts are that home prices will net positive this year.

So, if you believe home prices are falling, it may be time to get your insights from the experts instead – and they’re saying prices aren’t falling, they’re climbing.

Bottom Line

There’s been a lot of misleading information about home prices over the past year. And that’s still having an impact on how people are feeling about the housing market today. But it’s best not to believe everything you hear or read.

If you want information you can trust, turn to the real estate experts. Their data shows home prices are on the way back up and will net positive for the year. If you have questions about what’s happening in our local area, let’s connect.

The information contained, and the opinions expressed, in this article are not intended to be construed as investment advice. Keeping Current Matters, Inc. does not guarantee or warrant the accuracy or completeness of the information or opinions contained herein. Nothing herein should be construed as investment advice. You should always conduct your own research and due diligence and obtain professional advice before making any investment decision. Keeping Current Matters, Inc. will not be liable for any loss or damage caused by your reliance on the information or opinions contained herein.

Categories

- Baby Boomers

- Buying Myths

- Demographics

- Distressed Properties

- Down Payments

- First Time Home Buyers

- For Buyers

- For Sellers

- Foreclosures

- FSBOs

- Generation X

- Holidays

- Housing Market Updates

- Infographics

- Interest Rates

- Internal

- Luxury Market

- Member Exclusive Webinar

- Millennials

- Move-Up Buyers

- New Construction

- Pricing

- Rent vs. Buy

- Selling Myths