Evans Realty was established in 1985 and servicing the Treasure Valley for the past 39 years.

An Expert Makes All the Difference When You Sell Your House

If you’re thinking of selling your house, it’s important to work with someone who understands how the market is changing and what it means for you. Here are five reasons working with a professional can ensure you’ll get the most out of your sale.

1. They’re Experts on Market Trends

With today’s housing market defined by change, it’s critical to work with someone who knows the latest information and how it impacts your goals. An expert real estate advisor knows about national trends and your local area too. More importantly, they’ll give insight to what all of this means for you, so they’ll be able to help you make a decision based on trustworthy, data-bound information.

2. A Local Professional Knows How To Set the Right Price for Your Home

Home price appreciation has moderated this year. If you sell your house on your own, you may be more likely to overshoot your asking price because you’re not as aware of where prices are today. Pricing your house too high can deter buyers or cause your house to sit on the market for longer.

Real estate professionals look at a variety of factors, like the condition of your home and any upgrades you’ve made, with an unbiased eye. They compare your house to recently sold homes in your area to find the best price for today’s market so your house sells quickly.

3. A Real Estate Advisor Helps Maximize Your Pool of Buyers

Since buyer demand has cooled this year, you’ll want to do what you can to help bring in more buyers. Real estate professionals have a wide range of tools at their disposal, such as social media followers, agency resources, and the Multiple Listing Service (MLS), to ensure your house gets in front of people looking to make a purchase. Investopedia explains why it’s risky to sell on your own without the network an agent provides:

“You don’t have relationships with clients, other agents, or a real estate agency to bring the largest pool of potential buyers to your home.”

Without access to your agent’s tools and marketing expertise, your buyer pool – and your home’s selling potential – is limited.

4. A Real Estate Expert Will Read – and Understand – the Fine Print

Today, more disclosures and regulations are mandatory when selling a house. That means the number of legal documents you’ll need to juggle is growing. The National Association of Realtors (NAR) puts it like this:

“There’s a lot of jargon involved in a real estate transaction; you want to work with a professional who can speak the language.”

5. A Local Professional Is a Skilled Negotiator

In today’s market, buyers are regaining some negotiation power. If you sell without an expert, you’ll be responsible for any back-and-forth. That means you’ll have to coordinate with:

- The buyer, who wants the best deal possible

- The buyer’s agent, who will use their expertise to advocate for the buyer

- The inspection company, which works for the buyer and will almost always find concerns with the house

- The appraiser, who assesses the property’s value to protect the lender

Instead of going toe-to-toe with these parties alone, lean on an expert. They’ll know what levers to pull, how to address everyone’s concerns, and when you may want to get a second opinion.

Bottom Line

Don’t go at it alone. If you’re planning to sell your house this spring, let’s connect so you have an expert by your side to guide you in today’s market.

What You Should Know About Rising Mortgage Rates

After steadily falling over the winter, mortgage rates have started to rise in recent weeks. This is concerning to some potential homebuyers as the combination of higher mortgage rates and higher prices have made homes less affordable. So, if you’re planning to purchase a home this year, you too may be wondering if now’s the right time to buy or if you should hold off on your search until rates come back down.

The recent uptick in rates has been driven by what’s happening with inflation. Joel Kan, Vice President and Deputy Chief Economist at the Mortgage Bankers Association (MBA), explains:

“Mortgage rates increased across the board last week, pushed higher by market expectations that inflation will persist, thus requiring the Federal Reserve to keep monetary policy restrictive for a longer time.”

The most recent weekly average 30-year fixed mortgage rate reported by Freddie Mac is 6.5%. It’s the third week in a row that rates have increased and puts them at the highest point they’ve been this year (see graph below):

Advice for Home Shoppers

If you’re thinking about pausing your home search because rates have started to go up again, you may want to reconsider. This could actually be an opportunity to buy the home you’ve been searching for. According to the MBA, mortgage applications declined by 13.3% in just one week, so it appears the rise in mortgage rates is leading some potential homebuyers to pull back on their search for a new home.

So, what does that mean for you? If you stay the course, you’ll likely face less competition among other buyers when you’re looking for a home. This is welcome relief in a market that has so few homes for sale.

Bottom Line

Over the last few weeks, mortgage rates have risen. But that doesn’t mean you should delay your plans to buy a home. In fact, it could mean the opposite if you want to take advantage of less buyer competition. Let’s connect today to explore the options in our local market.

One Major Benefit of Investing in a Home

One of the many reasons to buy a home is that it’s a major way to build wealth and gain financial stability. According to Freddie Mac:

“Building equity through your monthly principal payments and appreciation is a critical part of homeownership that can help you create financial stability.”

With spring approaching, now’s a great time to consider if buying a home makes sense for you. The best way to figure that out is to talk with a trusted real estate professional.

The Largest Part of Most Homeowners’ Net Worth Is Their Equity

You may be surprised to learn just how much of a homeowner’s net worth actually comes from owning their home. The National Association of Realtors (NAR) shares:

“Homeownership is the largest source of wealth among families, with the median value of a primary residence worth about ten times the median value of financial assets held by families. Housing wealth (home equity or net worth) gains are built up through price appreciation and by paying off the mortgage.”

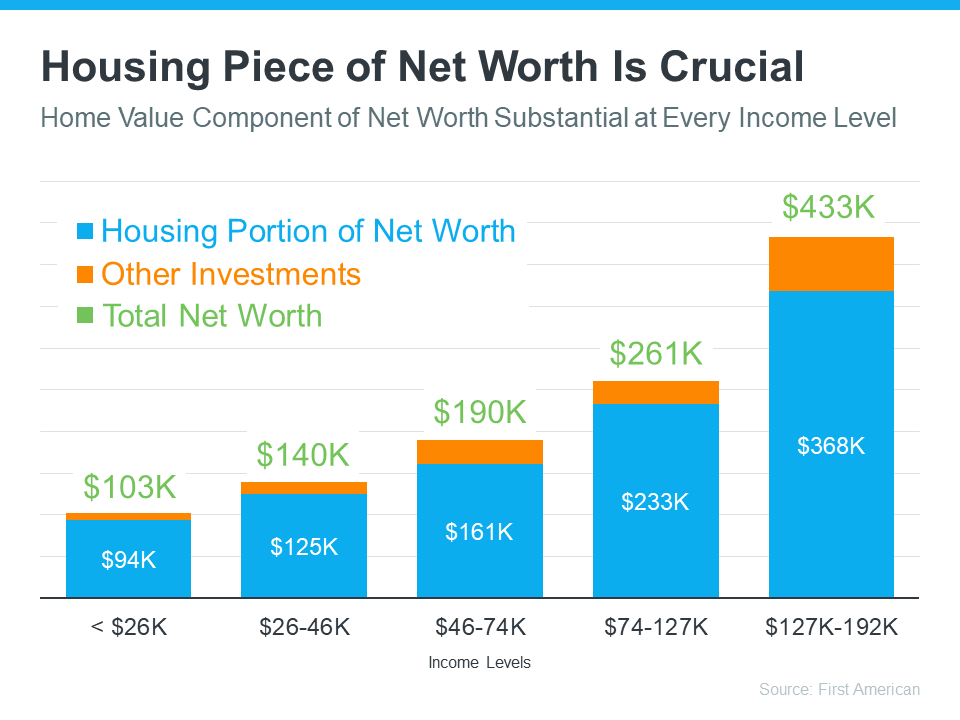

In other words, home equity does more to build the average household’s wealth than anything else. And according to data from First American, this holds true across different income levels (see graph below):

Bottom Line

One of the biggest benefits of owning a home, regardless of your income level, is that it provides financial stability and an avenue to build wealth. Let’s connect today so you can start investing in homeownership.

Checklist for Selling Your House This Spring [INFOGRAPHIC]

Some Highlights

- As you get ready to sell your house, there are specific things you can add to your to-do list.

- These include decluttering, taking down personal photos and items, and power washing outdoor surfaces.

- Let’s connect so you have advice on what you may want to do to get your house ready to sell this season.

How To Make Your Dream of Homeownership a Reality

According to a recent Harris Poll survey, 8 in 10 Americans say buying a home is a priority, and 28 million Americans actually plan to buy within the next 12 months. Homeownership provides many financial and nonfinancial benefits, so that interest is understandable.

However, it’s unlikely all 28 million Americans will accomplish that goal in the coming year. Experts project a total of around five million homes will be sold in 2023. Why is there such a big difference? It’s partly because there can be challenges to buying a home.

In the same survey, when asked, “Which of the following are preventing you from pursuing homeownership at this time?”:

- 34% answered, “I don’t have enough saved for a down payment”

- 30% answered, “My credit score”

If you’re aiming to buy a home, here’s what you need to know to accomplish that goal.

Save for Your Down Payment

Your down payment is a big chunk of what you pay up front for your home. For most home purchases, buyers put down some amount of cash up front (a down payment) and then take out a loan (a mortgage) to pay for the rest.

It’s a longstanding myth that you need to pay 20% of the purchase price for your down payment. In reality, 20% down isn’t always required. In fact, according to the National Association of Realtors (NAR), today’s median down payment is 14% for the average buyer and just 6% for a first-time buyer.

Regardless of how much money you can save for your down payment, know there’s help available. A local lender can show you options to help you get closer to your down payment goal. Plus, there are even loan types, like FHA loans, with down payments as low as 3.5% for some buyers, as well as options like VA loans and USDA loans with no down payment requirements for qualified applicants.

Beyond assistance programs and different loan types, here are a few other tips to help you as you save for your down payment:

- Remember to factor in closing costs. In addition to your down payment, closing costs are usually 2-5% of the home's purchase price.

- Maintain your savings. Your down payment shouldn’t deplete all your savings. It’s important to still have some money set aside for homeownership expenses after you move in.

- Explore your options and lean on your trusted advisor for expert guidance. Do your research, ask questions, and look into the resources available for buyers like you.

Improve Your Credit Score

Your credit score is a number that indicates how financially reliable you are to lenders. A higher credit score usually means you’ll be able to borrow more money at a better interest rate. If your credit score is preventing you from getting an affordable mortgage, there are steps you can take to improve it. Here are two:

- Pay your bills on time. When you pay your bills on time, your credit score improves. When you’re late, it takes a hit. One way to make paying your bills on time easier? Set up automatic payments when and where you can.

- Mix it up. From auto loans, to credit cards, to mortgages – there are several different types of credit. And having a mix of them improves your credit score.

Bottom Line

If you want to purchase a home this year, let’s connect so we can start preparing.

![Checklist for Selling Your House This Spring [INFOGRAPHIC] | Simplifying The Market](https://files.simplifyingthemarket.com/wp-content/uploads/2023/02/22133439/Checklist-For-Selling-This-Spring-MEM.png)